Table of Content

- Are the interest rates of a House Renovation Loans higher than that of a Home Loan ?

- Conversion Fees

- Home Loan Eligibility Calculator

- Charges and Feesfor Self Employed individuals

- Can I get an approval for a home loan while I decide which property, I should purchase?

- What is a pre-EMI interest on a home loan?

- Statutory / Regulatory Charges

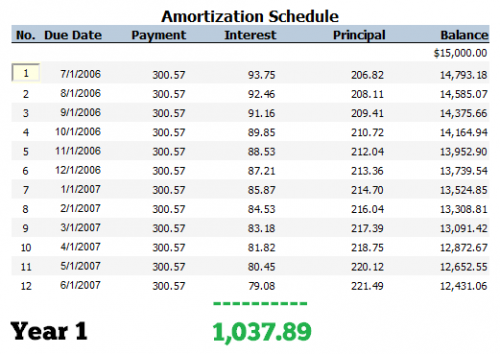

Our chat service on our website and WhatsApp are available 24X7 to assist you with your housing loan related queries. HDFC’s online home loans provide you the facility to apply for a home loan online from the safety and convenience of your home or office. The Home Loan Amortization Schedule gives a detailed table for month-wise calculation of EMIs. It represents the breakdown of the principal and interest amount paid towards the home loan every year in the form of the repayment amount. This helps to make a judicious decision about the housing loan EMIs every month. It will also show the total amount paid towards the principal, the interest amount charged, and the total amount payable towards the loan.

This will impact his eligibility to get other loans in the future. Borrowers are advised to keep an emergency fund so that their EMI payments are not impacted. Interest Rate – The interest rate is the rate charged by HDFC on the home loan. It depends on the type of loan and the nature of the applicant, whether salaried or self-employed, and the type of the property. If the interest rate is higher, the home loan EMI will also be higher, and so will be the total cost of the loan. One can calculate their EMIs using HDFC Home Loan EMI calculator before applying for a home loan.

Are the interest rates of a House Renovation Loans higher than that of a Home Loan ?

With HDFC's House Renovation Loans you can upgrade your existing home to a contemporary design and a more comfortable living space. We are unable to show you any offers currently as your current EMIs amount is very high. You can go back and modify your inputs if you wish to recalculate your eligibility. Delayed payment of interest or EMI shall render the customer liable to pay additional interest up to 24% per annum.

However, you can calculate the EMI amount on your loan anytime using the HDFC home loan calculator 2021. For security, one can keep the mortgage on the property they are planning to buy, renovate or construct. Buying a house is one of the biggest and most important decisions of a lifetime. A good house is essential for the all-round well-being of a family. For Home Renovation and Top-Up Loans, the maximum tenure is 15 years or till the age of retirement, whichever is lower. For Home Extension Loans, the maximum tenure is 20 years or till the age of retirement, whichever is lower.

Conversion Fees

You can apply individually or jointly for House Renovation Loans All owners of the property will have to be co-applicants. All the information contained herein above is for awareness and customer convenience and is intended to only act as an indicative guide about HDFC’s products and services. For detailed information about HDFC’s products and services kindly visit the nearest HDFC branch.

The HDFC Home Loan EMI calculator will also provide a Home Loan Amortization table showing the repayment schedule. Home loan eligibility calculator gives an accurate estimate of the Home Loan that you can borrow from HDFC. HDFC Sales website also allows you to apply for a Home Loan online, even if you have not finalized the property. Just fill in your details and our representative will handhold you through the entire process.

Home Loan Eligibility Calculator

This helps estimate the loan amount that can be availed and helps in assessing the own contribution requirements and cost of the property. Therefore knowing the EMI is crucial for calculation of home loan eligibility and planning your home buying journey better. HDFC home loans, known as rural housing loans, are tailored for agriculturists, planters, etc for purchasing residential properties in rural areas. Agriculturists applying for loans are not required to provide income tax returns. The maximum repayment tenure depends on the type of housing loans you are availing, your profile, age, maturity of loan etc. The documentation needed to be submitted along with your home loan application form is available here.

Retrieve your original papers after prepayment of loan and take the acknowledgment of the same mentioning all the details of the prepayment. The borrower has to pay prepayment charges that usually vary between 2% to 4% depending on the lending company. Fixed-rate of interest remains constant throughout the loan tenure.

You can apply for a house loan with minimal income documentation with HDFC Reach. Post the fixed rate tenure, the loan switches to an adjustable rate. Check with the lender if the property that you have shortlisted will be considered for a housing loan.

Ensure that the documentation of your home loan application is in order as per the requirement of the lender. You can now apply for a home loan online in 4 simple steps with HDFC’s quick and easy apply online module. It is advisable to evaluate your current debts or other EMI obligations before taking a home loan from HDFC. The amount of debts you will have will influence your EMIs and increase the burden on your repayments. It gives you a clear understanding of your finances - both your home loan eligibility and the amount you can arrange from your own sources thus helping you fix a budget for your home purchase.

Loan Amount – This amount borrowed from HDFC for a home loan by a borrower affects his home loan EMI. With HDFC, you can get a home loan for a minimum of Rs. 5 lakhs up to Rs. 5 crores. Enter the type of property required and the city of residence. Home Loan eligibility can also be considered an indicator of your Home Loan affordability. It is always advisable to calculate your Home Loan eligibility using the HDFC Sales Home Loan Eligibility calculator.

This online tool works on loan parameters like loan amount, interest rate, and loan tenure. A home loan is the amount of money borrowed to purchase or construct a home by an individual. You can apply for a pre approved home loan which is an in-principal approval for a loan given on the basis of your income, creditworthiness and financial position.

You can download account statements, interest certificates, request for home loan disbursement and do much more. By using the calculator, customers can gain a clear understanding of the EMI that the borrowers need to keep ready every month. Based on the inputs provided, our Home Loan Eligibility Calculator calculates your loan eligibility in real-time and displays the result in an intuitive design. Enter your details in four easy steps to receive your loan eligibility. Up to 1.25% of the loan amount or ₹3,000 whichever is higher, plus applicable taxes.

No comments:

Post a Comment