Table of Content

The Borrower will be required to submit such documents that HDFC may deem fit & proper to ascertain the source of funds at the time of prepayment of the loan. The floating rate of interest varies from time to time depending on the changes in government rules, RBI policy, supply of money, etc. Credit Linked Subsidy Scheme under PMAY makes the home finance affordable as the subsidy provided on the interest component reduces the outflow of the customer on the home loan. The subsidy amount under the scheme largely depends on the category of income that a customer belongs to and the size of the property unit being financed. Our HDFC Reach Loans make home buying possible for micro-entrepreneurs and salaried individuals who may or may not have sufficient proof of income documentation.

Your actual loan tenure — and EMI payments — begins once the Pre-EMI phase is over i.e. post the house loan has been fully disbursed. You can apply for housing loans at any time once you have decided to purchase or construct a property, even if you have not selected the property or the construction has not commenced. You can even apply for a home loan whilst you are working abroad, to plan for your return to India in future. With the help of the HDFC EMI calculator, one can get a clear picture and understanding of the proportion of the principal amount to the interest due that one has to pay. This will be based on the interest rates and the loan tenure.

How does your home loan repayment work?

Such fees is payable directly to the concerned advocate / technical valuer for the nature of assistance so rendered. Up to 1.50% of the loan amount or ₹4,500 whichever is higher, plus applicable taxes. Security of the loan would generally be security interest on the property being financed and / or any other collateral / interim security as may be required by HDFC. Security of the loan would generally be security interest on the property being financed by us and / or any other collateral / interim security as may be required by us. You are eligible for tax benefits on the principal components of your house renovation loan under the Income Tax Act, 1961.

The reset can be according to the financial calendar, or they can be unique to each customer, depending on the first date of disbursement. Repayment of home loans is done through Equated Monthly Installments , which is a combination of interest and principal. In the case of loans for resale homes, EMI begins from the month subsequent to the month in which disbursement of the loan is done. In the case of loans for under-construction properties, EMI usually begins once the construction is complete and the house loan is fully disbursed. Customers can however also choose to begin their EMIs sooner.

How much loan could I borrow?

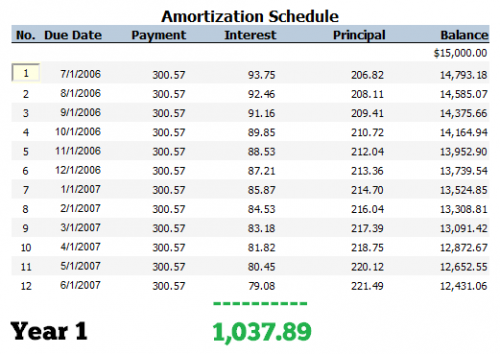

Such type of loan can be taken by the landowner to built or construct your new house. HDFC Ltd. also provides home improvement loans, home extension loans, top-up loans, and many more such home loans. If you have taken a loan of Rs 10 Lakh over a period of 10 years or 120 months at 12% annual interest, the amortisation schedule will be the following.

Our chat service on our website and WhatsApp are available 24X7 to assist you with your housing loan related queries. HDFC’s online home loans provide you the facility to apply for a home loan online from the safety and convenience of your home or office. The Home Loan Amortization Schedule gives a detailed table for month-wise calculation of EMIs. It represents the breakdown of the principal and interest amount paid towards the home loan every year in the form of the repayment amount. This helps to make a judicious decision about the housing loan EMIs every month. It will also show the total amount paid towards the principal, the interest amount charged, and the total amount payable towards the loan.

More on How to Improve Home Loan Eligibility?

This link provides a detailed checklist of KYC, Income and property related documents required for the processing of your home loan application. The checklist is indicative and additional documents could be asked for during the home loan sanction process. Such type of loan helps the individual who wishes to purchase a new home by selling off the existing property. Through this loan, you can make the down payment for the new property till the old property is sold off. Pre-EMI is the monthly payment of interest on your home loan. This amount is paid during the period till the full disbursement of the loan.

If you purchase an under construction property you are generally required to service only the interest on the loan amount drawn till the final disbursement of the loan and pay EMIs thereafter. In case you wish to start principal repayment immediately you may opt to tranche the loan and start paying EMIs on the cumulative amounts disbursed. The prepayment charges are subject to change as per prevailing policies of HDFC and accordingly may vary from time to time which shall be notified on . HDFC home loan can be availed for purchasing the independent house, villa, apartment, etc. HDFC Ltd. finances Indian residents up to 90% of the total property cost. A home loan is one of the most widely availed financial products in India.

How can the HDFC Home EMI Calculator Help You?

An online EMI calculator is easily accessible online from anywhere. You can try various combinations of the input variable as many times as required to arrive at the right home loan amount, EMIs, and tenure best suited to your needs. An EMI calculator is useful in planning your cash flows much in advance, so that you make your home loan payments with ease whenever you avail a home loan. In other words, an EMI calculator is a useful tool for your financial planning and loan servicing needs. FLIP offers a customized solution to suit your repayment capacity which is likely to alter during the term of the loan.

With our experience of providing home finance for over 4 decades, we are able to understand the diverse needs of our customers and fulfill their dream of owning a home . Home Loan EMI Calculator assists in calculation of the loan installment i.e. It an easy to use calculator and acts as a financial planning tool for a home buyer. You can take disbursement of the loan once the property has been technically appraised, all legal documentation has been completed and you have invested your own contribution in full.

This helps estimate the loan amount that can be availed and helps in assessing the own contribution requirements and cost of the property. Therefore knowing the EMI is crucial for calculation of home loan eligibility and planning your home buying journey better. HDFC home loans, known as rural housing loans, are tailored for agriculturists, planters, etc for purchasing residential properties in rural areas. Agriculturists applying for loans are not required to provide income tax returns. The maximum repayment tenure depends on the type of housing loans you are availing, your profile, age, maturity of loan etc. The documentation needed to be submitted along with your home loan application form is available here.

Basis these three input values, the EMI calculator will compute the instalment you need to pay to the home loan provider each month. Some EMI calculators for home loan also provide a detailed breakup of the interest and principal amount you will be paying over the entire loan tenure. HDFC also offers a facility of a pre-approved home loan even before you have identified your dream home. A pre-approved home loan is an in-principal approval for a loan given on the basis of your income, creditworthiness and financial position. It includes repayment of the principal amount and payment of the interest on the outstanding amount of your home loan.

This will impact his eligibility to get other loans in the future. Borrowers are advised to keep an emergency fund so that their EMI payments are not impacted. Interest Rate – The interest rate is the rate charged by HDFC on the home loan. It depends on the type of loan and the nature of the applicant, whether salaried or self-employed, and the type of the property. If the interest rate is higher, the home loan EMI will also be higher, and so will be the total cost of the loan. One can calculate their EMIs using HDFC Home Loan EMI calculator before applying for a home loan.

Retrieve your original papers after prepayment of loan and take the acknowledgment of the same mentioning all the details of the prepayment. The borrower has to pay prepayment charges that usually vary between 2% to 4% depending on the lending company. Fixed-rate of interest remains constant throughout the loan tenure.

We will disburse your loan in installments based on the progress of construction/renovation as assessed by HDFC. Loans against property / Home Equity Loan for Business Purpose i.e. Incidental charges & expenses are levied to cover the costs, charges, expenses and other monies that may have been expended in connection with recovery of dues from a defaulting customer. A copy of the policy can be obtained by customers from the concerned branch on request. You can apply individually or jointly for House Renovation Loans. This type of loan allows borrowing some more amount of money above the outstanding loan amount.

The loan is structured in such a way that the EMI is higher during the initial years and subsequently decreases in proportion to the income. Details of ongoing loans of the individual and the business entity including the outstanding amount, instalments, security, purpose, balance loan term, etc. Any person who wishes to carry out renovation in their Apartment/Floor/Row house. Existing home loan customers can also avail a House Renovation Loans. The information contained in this website is for general information purposes only.

No comments:

Post a Comment